Personal taxes - thresholds and allowances

Income tax thresholds

Following the U-turn from the 2022 September ‘Mini Budget’ removing the 45% additional rate of income tax, the Chancellor has now gone the other way and decreased the threshold for the additional rate of income tax from £150,000 to £125,140, with effect from 6 April 2023. This measure will not apply to taxpayers in Scotland with regard to non-dividend and non-savings income (to which Scottish income tax rates and thresholds apply instead).

The income tax personal allowance, which had previously been fixed at its current level (£12,570) until April 2026 will be frozen for a further two years, until April 2028. The same applies to the National Insurance primary threshold which was harmonised with the income tax personal allowance with effect from July 2022. This measure will apply across the UK.

The Government will legislate for these income tax measures in the Autumn Finance Bill 2022. Set out below are the tax bands for non-dividend and non-savings income, as applicable to individual taxpayers in England, Wales and Northern Ireland from 6 April 2023.

| Band | Taxable income | Tax rate |

| Personal allowance | £12,570 | 0% |

| Basic rate | £12,571 to £50,270 | 20% |

| Higher rate | £50,271 to £125,140 | 40% |

| Additional rate | Over £125,140 | 45% |

Income tax – dividend allowance

The dividend allowance will be reduced from its current level of £2,000 to £1,000 from April 2023, and then be further reduced to £500 from April 2024.

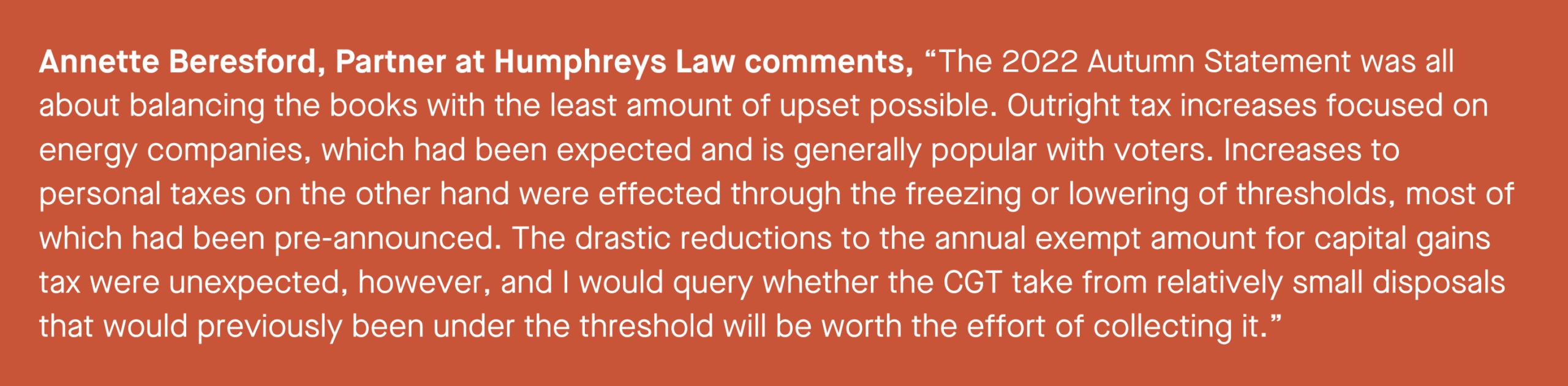

Capital gains tax – annual exempt amount

The annual exempt amount for capital gains tax will be reduced from its current level of £12,300 to £6,000 from April 2023, and then be further reduced to £3,000 from April 2024. This will result in an increased compliance burden for many taxpayers as large numbers of small disposals which would previously have been below the threshold will now be caught once the measure takes effect.

Inheritance tax threshold

The inheritance tax nil-rate bands, which had already been frozen until April 2026, will now remain at their current levels until April 2028. The nil-rate band will continue to be £325,000 and the residence nil-rate band will continue to be £175,000, meaning that qualifying estates can continue to pass on up to a total of £500,000 and the qualifying estate of a surviving spouse or civil partner can continue to pass on up to £1 million without incurring an inheritance tax liability. The residence nil-rate band taper will continue to start at £2 million.