News & Insight

Anatomy of a priced UK venture capital funding round

H

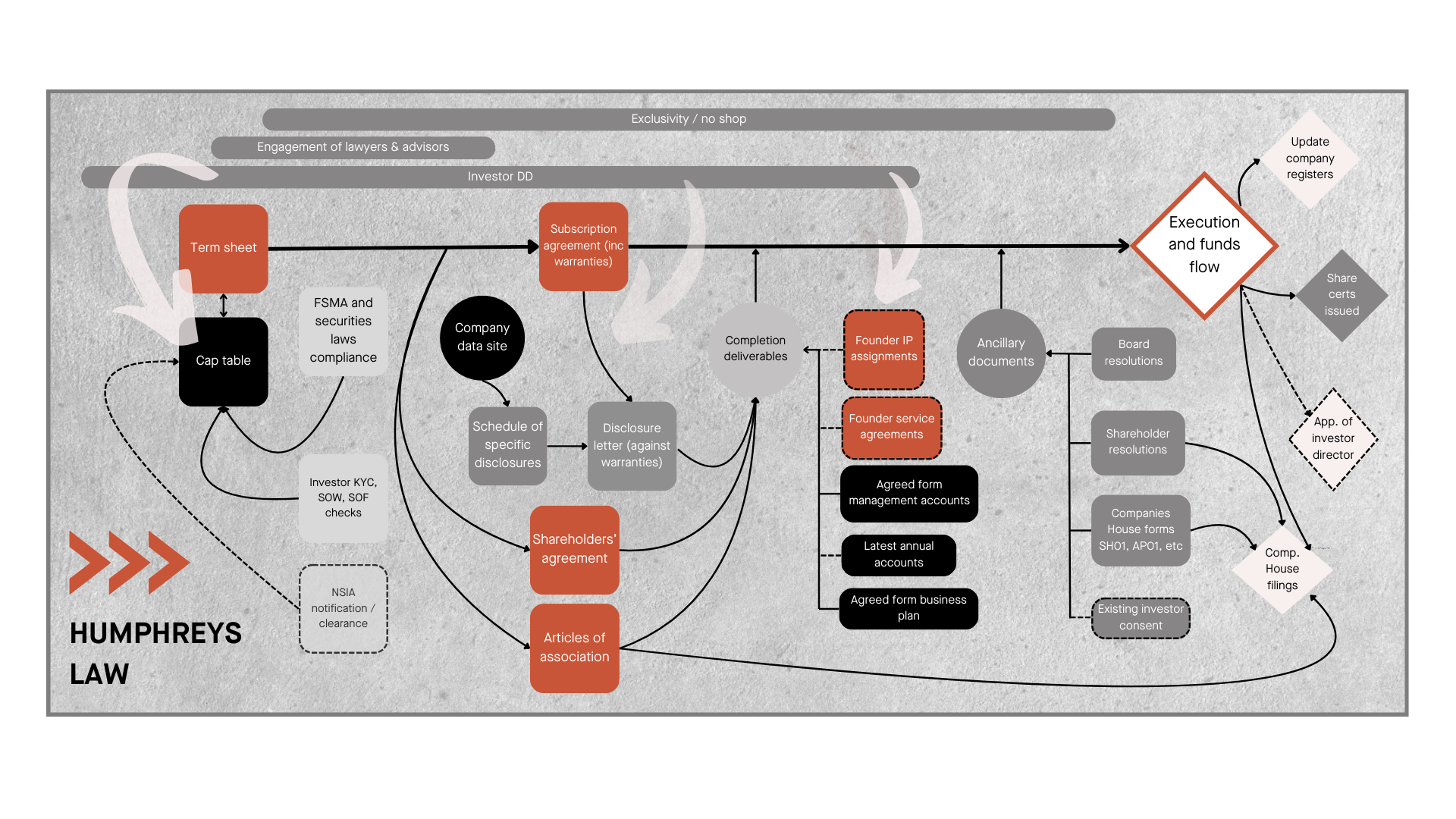

ave you ever wondered what a ‘priced’ UK venture capital funding round looks like as a flow chart? We put one together for you…

This is a visual representation of the most basic formulation of a ‘priced’ VC funding round, and so does not factor in any conversion of CLNs, SAFEs or ASAs. Very often there are completion deliverables involved but which are not featured in the above, such as investor side letters and conditions precedent (such as a pre-completion stock split or the termination of certain existing documents). No two deals are the same. Every deal has its own quirks and specific circumstances. Market practice changes all the time.

All the thoughts and commentary that HLaw publishes on this website, including those set out above, are subject to the terms and conditions of use of this website. None of the above constitutes legal advice. Much of the above will no doubt fall out of date and conflict with future law and practice one day. None of the above should be relied upon. Always seek your own independent professional advice.

Humphreys Law

If you would like to contact a member of our team, please get in touch by filling in the form below.

"*" indicates required fields

Humphreys Law